- Dapatkan link

- Aplikasi Lainnya

- Dapatkan link

- Aplikasi Lainnya

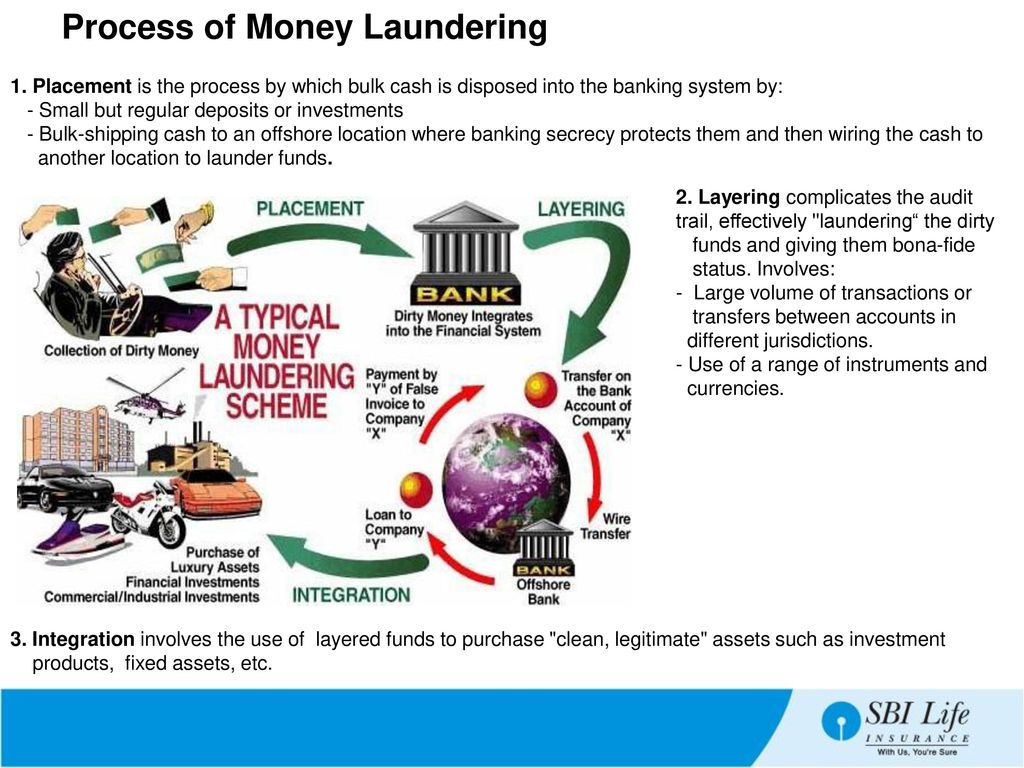

The idea of money laundering is very important to be understood for those working within the monetary sector. It is a process by which soiled money is transformed into clear money. The sources of the money in precise are felony and the cash is invested in a way that makes it appear to be clear money and conceal the id of the criminal part of the cash earned.

While executing the monetary transactions and establishing relationship with the new prospects or sustaining current prospects the obligation of adopting satisfactory measures lie on each one who is a part of the organization. The identification of such ingredient in the beginning is straightforward to take care of instead realizing and encountering such situations later on in the transaction stage. The central financial institution in any nation supplies full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to discourage such conditions.

It is meant to make the trailing of illegal proceeds difficult for the law enforcement agencies. Layering is the continuing transfer of the money through multiple transactions forms investments or enterprises to make it virtually impossible to trace the money back to its illegal origin.

Money Laundering Activities In Australia An Examination Of The Push And Pull Factors Driving Money Flows Sciencedirect

During the layering stage the goal is to disconnect the money from the illegal activity that generated it.

Layering in terms of money laundering means. A money launderer or the criminal themselves engages in a series of transactions to create layers between the illegal source of the cash they control. The primary purpose of this stage is to separate the illicit money from its source. At this stage the money introduced in the economy is then covered by means of a number of conversions of the funds to change its form and to make it difficult to find out the original source of the money.

Placement layering and integration. Final integration is when the money is freely used legally without the necessity to conceal it any further. Here the illicit money is separated from its source.

The second stage is layering sometimes its also referred to as. Layering The purpose of this stage is to make it more difficult to detect and uncover a laundering activity. This is the most vulnerable stage of money laundering as criminals are holding on to a bulk of funds and placing it into the financial system which may attract the attention of law enforcement agencies.

Placement is the most difficult step. Money launderers play smartly and use only a little portion of the chips because there is uncertainty in gambling games. After placement comes the layering stage sometimes referred to as structuring.

Put together money laundering essentially means to washclean money. Placement is the depositing of funds in financial institutions or the conversion of cash into negotiable instruments. The Layering Process Layering is often considered the most complex component of the money laundering process because it deliberately incorporates multiple financial instruments and transactions to confuse AML controls.

During this initial phase the money launderer introduces his illegal proceeds into the financial system. Generally the more layers money passes through the. The next stage of money laundering layering allows criminals to remove that traceability and lend legitimacy to their funds.

The second phase of the classic three-step money laundering process between placement and integration layering involves distancing illegal proceeds from their source by creating complex levels of financial transactions designed to disguise the audit trail and to provide anonymity. The layering stage is the most complex and often entails the international movement of the funds. This can be done by spreading it over various complex transactions in a number of bank accounts internationally.

There are many ways of money laundering which are explained in the articles linked at the end of this post. A simpler definition of money laundering would be a series of financial transactions that intend to transform ill-gotten gains into legitimate money or other assets. The Layering Stage Camouflage.

Therefore they use chips for a. Meaning and Definition Definition of Money Laundering. The criminal moves laundered money back into the financial system.

The layering stage is the most complex and often entails the international movement of the funds. In the real world money laundering is the act of cleaning large sums of illegal money ie making it seem as if the money has been obtained as the result of a legal sourceactivity. Money laundering usually consists of three steps.

Layering is done in gambling by taking the cash or chips into the casinos and used for playing betting games.

What Is Anti Money Laundering Aml Anti Money Laundering

Aml Cft Guidelinelawyers And Conveyancers Dia Govt Nz

Money Laundering Definition Business Meaning Pronunciation Translations And Examples

Money Laundering Activities In Australia An Examination Of The Push And Pull Factors Driving Money Flows Sciencedirect

Money Laundering Definition Business Meaning Pronunciation Translations And Examples

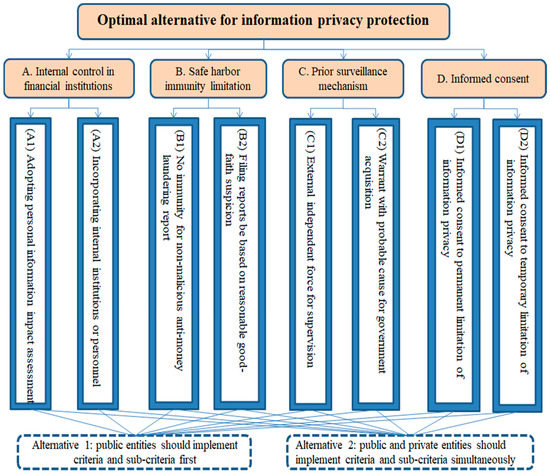

Mathematics Free Full Text Information Privacy Protection Under Anti Money Laundering Legislation An Empirical Study In Taiwan Html

Anti Money Laundering Practices Ppt Download

Aml Cft Guidelinelawyers And Conveyancers Dia Govt Nz

Pdf Afc738 Money Laundering Test 1 Question 1 A Define Money Laundering 2 Marks Nuha Marzukai Academia Edu

Doc Basics Of Money Laundering Doc Abdinasir Ali Academia Edu

Techniques Used To Facilitate Money Laundering Through Real Estate Download Scientific Diagram

Anti Money Laundering Practices Ppt Download

Prevention Of Money Laundering Act 2002

The world of rules can seem to be a bowl of alphabet soup at occasions. US cash laundering regulations aren't any exception. We've got compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Risk is consulting agency targeted on protecting financial providers by lowering danger, fraud and losses. Now we have large financial institution experience in operational and regulatory risk. Now we have a robust background in program management, regulatory and operational danger in addition to Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many adversarial penalties to the group because of the risks it presents. It will increase the chance of major dangers and the chance price of the financial institution and in the end causes the financial institution to face losses.

Komentar

Posting Komentar